North American robot orders increase in Q3 2025, reports A3

Non-automotive sectors led Q3 unit orders as companies made long-term investments to address workforce challenges and reshoring costs. Source: A3

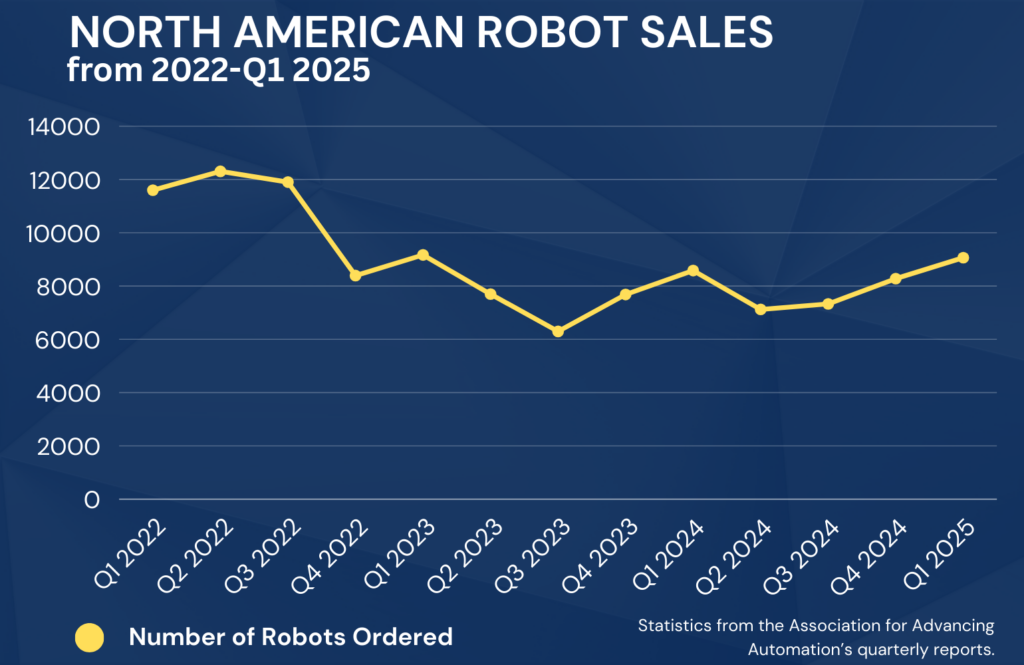

After a drop last year and steady sales in the first half of 2025, North American robot orders increased in the Q3 of 2025, according to the Association for Advancing Automation, or A3.

Third-quarter orders totaled 8,806 robots valued at $574 million, an 11.6% increase in units, an 11.6% increase in units and a 17.2% rise in revenue compared with the same period in 2024. In the first half of 2025, robot orders had increased by 4.3%, and revenue had risen 7.5% from the same period last year.

A3 is a leading global advocate for the business benefits of automation. The Ann Arbor, Mich.-based organization‘s membership includes more than 1,400 manufacturers, component suppliers, system integrators, end users, academic institutions, research groups, and consulting firms worldwide.

Automotive and consumer goods drive quarterly gains

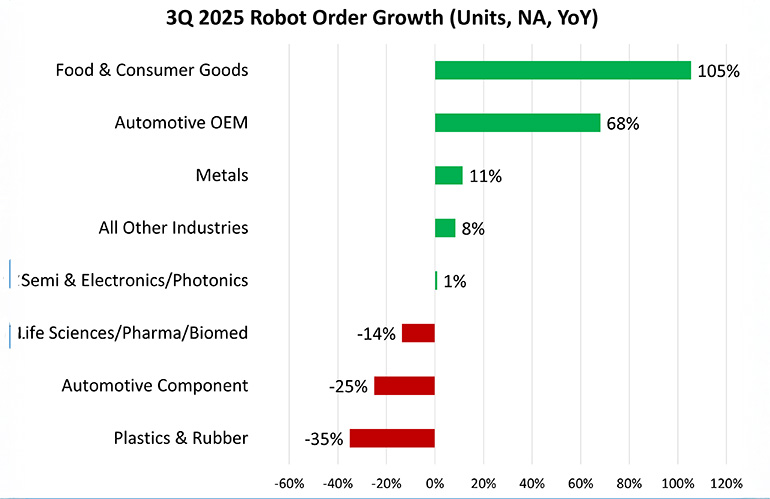

A3 noted that key growth sectors in Q3 included food and consumer goods, which jumped 105% year over year, and automotive OEMs, which rose 68%. Additional gains came from metals (+11%) and all other industries (+8%), contributing to broad-based improvement across the quarter.

By contrast, automotive component orders declined 25%, and plastics and rubber fell 35%, reflecting sector-specific capital slowdowns, said A3.

The non-automotive sector continued to lead the robotics market in 3Q 2025, accounting for 59% of all robots ordered, according to the latest data. A3 said this majority share reflected accelerating momentum across industries, including food and consumer goods, metals, and general manufacturing.

“These gains highlight a broader shift as manufacturers across diverse sectors turn to automation to enhance productivity as well as address labor shortages, reshoring pressures, and changing customer demands,” the organization said.

“We’re seeing growth continuing in newer industries, which is encouraging,” Jeff Burnstein, president of A3, told The Robot Report. “That balances out the drop-offs in industries like automotive.”

Cobot market expands

A3 began officially reporting force- and power-limited robot volumes earlier this year. In Q3 2025, companies ordered 1,174 so-called collaborative robots valued at $42 million, accounting for 13.3% of total units and 7.2% of total revenue.

Across the first nine months of 2025, cobot orders reached 4,259 units valued at $156 million, representing 16.1% of units and 9.4% of total revenue, said A3. It said it plans to expand future reporting on these robots to include growth rates and sector-specific trends.

Q3 performance picks up year-to-date totals

From January through September 2025, North American companies ordered 26,441 robots valued at $1.7 billion. These volumes represent a 6.6% increase in units and a 10.6% increase in revenue compared with the same period in 2024.

“It’s encouraging to see robotics demand improve over last year, with more automation projects steadily returning to the pipeline,” stated Alex Shikany, executive vice president at A3. “The market has experienced a substantial amount of economic and policy uncertainty this year, and it’s been a challenging environment for capital investment, but there is upside.”

“We’re seeing sustained interest from companies across the region, with attendance rising at events like Automate, and more leaders are exploring automation as a long-term strategy to strengthen their operations,” he added. “That enthusiasm is now starting to show up in the order data, particularly across general industry sectors. As industrial production improves into 2026 and supply chains stabilize, we expect automation to remain a strategic priority for manufacturers looking to compete, build resilience, and address persistent workforce pressures.”

A3 said more detailed information is available to member companies in the A3 Vault and its new MI+ premium market intelligence platform. The association also hosts industry events including the the A3 Business Forum in January in Orlando, Fla., and Automate in June in Chicago.