iRobot debt acquired by contract manufacturer as bankruptcy looms

The Roomba Plus 405 Combo robot + AutoWash dock is 50% off for Cyber Week. Source: iRobot

The fortunes of one of the few household names in robotics have continued to sink. In a filing with the U.S. Securities and Exchange Commission last week, iRobot Corp. said that a Chinese company has acquired its debt and that it is still looking for alternatives to bankruptcy.

Santrum Hong Kong Co., a subsidiary of Shenzhen, China-based Picea Robotics Co., has acquired a credit agreement from affiliates of The Carlyle Group worth $190.6 million in principal and interest, said the SEC filing.

“As of November 24, 2025, the company owed Picea $161.5 million for the manufacturing of products, $90.9 million of which was past due,” said iRobot. “The company and Picea are engaged in active discussions regarding a mutually agreeable resolution of the non-payment by the company of amounts owed to Picea.”

In short, iRobot is not currently able to pay its contract manufacturer, which is now also its primary creditor. The Bedford, Mass.-based robotic vacuum company owes a total of more than $350 million.

Roomba maker runs into multiple obstacles

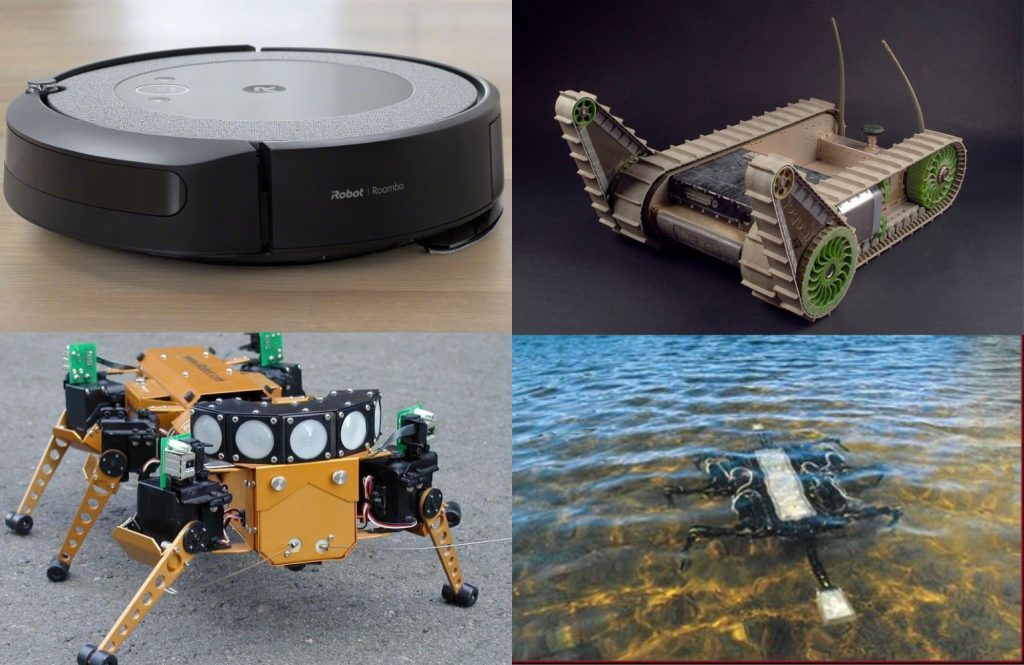

Since 2002, iRobot has sold more than 50 million systems worldwide. In 2016, activist investors pressured the company to sell its defense unit, limiting its ability to diversify.

iRobot’s financial troubles date back to at least 2022, when co-founder and CEO Colin Angle refuted claims that its Roombas might share private information while mapping homes.

Amazon.com Inc. announced plans to acquire iRobot for $1.7 billion, but the U.S. Federal Trade Commission raised antitrust concerns. The company also laid off 10% of its staff in August 2022, blaming them on a restructuring, weak demand, and inflation.

In 2023, the European Union added to iRobot’s antitrust woes, even though the UK Competition and Markets Authority had cleared the transaction. The EU’s preliminary finding indicated that the acquisition “may restrict competition” in the robotic vacuum cleaner market.

At the same time, cheaper models from China and more capable competition from vendors such as Dyson affected iRobot, as did its delayed attempts to get into the robotic lawn mower market. Amazon and iRobot called off their deal in early 2024, leading to more layoffs and Angle’s departure as CEO.

iRobot then named Gary Cohen as CEO that May. In late 2024, iRobot laid off 105 employees, reducing its global workforce by nearly 50% from the start of that year.

In August 2025, iRobot noted that its second-quarter earnings of $127.6 million were down 23.3% year over year. It was burning through its remaining $24.8 million in cash, partly from the Amazon settlement, as of September.

Early last month, the company reported that it had “no sources” of additional capital and that it was exploring its options in the hopes of finding a partner or buyer for the well-known consumer brand.

Chart created by Google Gemini and verified by The Robot Report.

iRobot prospects dim

In the SEC filing, iRobot noted that its stock price fell in reaction to its update on its strategic review process. It said a potential bidder withdrew from negotiations in October after offering “a price per share to acquire our company that was significantly lower than the trading price of our stock over the recent months prior to the counterparty’s withdrawal.”

iRobot said it will not provide further updates rather than see its stocks continue to decline. “It is unlikely that our ongoing review of strategic alternatives will result in any transaction being consummated outside of a bankruptcy process,” it acknowledged.

Such a process would result in creditors and stockholders receiving no return, and the company might then have to shut down.

Santrum gave iRobot until Jan. 15, 2026, to provide audited financials and maintain a minimum level of core assets under its loan terms. This delays payment of $5.1 million in interest that was due in Oct. 28.

If the company is unable to meet those conditions, and if Santrum decides not to extend the waiver, Picea could then seize assets, and iRobot would be forced to declare bankruptcy. The Robot Report will continue following developments closely.