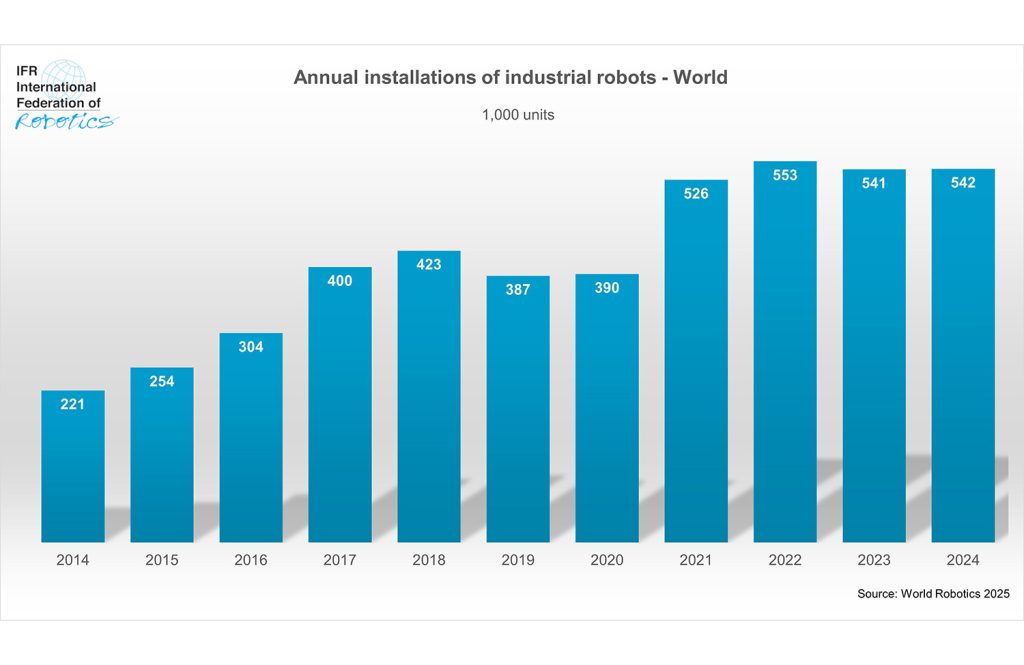

industrial robot deployments have doubled in 10 years

Annual installations of industrial robots worldwide. | Source: IFR

The International Federation of Robotics (IFR) today released its World Robotics 2025 Report that showed 542,000 industrial robots were installed worldwide in 2024. This is more than double the number installed 10 years ago, the IFR noted.

Annual installations topped 500,000 units for the fourth straight year. Asia accounted for 74% of new deployments in 2024, compared with 16% in Europe and 9% in the Americas.

“The new World Robotics statistics show 2024 the second-highest annual installation count of industrial robots in history – only 2% lower than the all-time high two years ago,” said IFR president Takayuki Ito. “The transition of many industries into the digital and automated age has been marked by a huge surge in demand. The total number of industrial robots in operational use worldwide was 4,664,000 units in 2024 – an increase of 9% compared to the previous year.”

China is world’s strongest robotics market

China’s annual installations of industrial robots from 2014-2024. | Source: IFR

China is by far the world’s largest robotics market in 2024, the IFR said. It represents 54% of global deployments. The latest figures show that 295,000 industrial robots have been installed in the country, the highest annual total on record, according to the IFR’s numbers.

Notably, for the first time, Chinese manufacturers have sold more than foreign suppliers in their home country. Their domestic market share climbed to 57% last year, up from about 28% over the past decade. China’s operational robot stock exceeded the 2 million mark in 2024, the largest of any country.

Additionally, as robotics in China is opening up new markets, there is no indication that robot demand in China will decrease. There is still a lot of potential in Chinese manufacturing for 10% growth on average each year until 2028, the IFR said.

Outside of China, Asian countries still lead in robotics

India has seen a large increase in robot installations in recent years. | Source: IFR

Japan maintained its position as the second-largest market for industrial robots, with 44,500 units installed in 2024. This represents a slight 4% decrease from 2023. The country’s operational stock rose by 3%, with 450,500 units now in use.

Demand for robots will grow slightly by lower single-digit rates in 2025. It will then accelerate to a medium single-digit rate on average in the next few years, the IFR said.

The market in the Republic of Korea installed 30,600 units in 2024, down 3%. Annual installations had been trending sideways of around 31,000 units since 2019. The country is the fourth largest robot market in the world in terms of annual installations in 2024, after the United States, Japan, and China.

India continues to grow with a record of 9,100 units installed in 2024 – up 7%. The automotive industry was the strongest driver with a market share of 45%. In terms of annual installations, India ranks sixth worldwide, one place up behind Germany.

Industrial robot installations fall slightly in Europe

The IFR said it doesn’t expect the EU’s automotive industry to drive growth for robotics in 2025. | Source: IFR

Industrial robot installations in Europe fell 8% to 85,000 units in 2024, still the second largest number recorded in history. 80%, 67,800 units, of all European robot installations took place in the European Union. Robot demand in Europe benefited from the nearshoring trend. The annual average growth rate from 2019 to 2024 was plus 3%.

Germany is the largest robot market in Europe and the fifth-largest in the world. Installations fell 5% to 26,982 units in 2024, which is the second-best result recorded after the record year of 2023. This represents a 32% market share of the annual total in Europe.

The number of installations in Italy, the second largest European market, fell by 16% to 8,783 units. Spain is now in third place (5,100 units), with a strong demand from the automotive industry. France (4,900 units) moved down to fourth place, with a 24% decrease.

In the UK, industrial robot installations were down 35% to 2,500 units in 2024. The record number of 3,800 units in 2023 was a one-off peak, driven by the “super-deduction” tax credit program, which ended after the first quarter of 2023. Installation counts moved sideways with some cyclicity over the past decade. Robot installations in the UK rank 19th worldwide in 2024.

U.S. remains largest market in the Americas

China has five times more operational stock of industrial robots than the U.S. | Source: IFR

Robot installations in the Americas exceeded 50,000 units for the fourth year in a row: 50,100 units were installed in 2024, down 10% below the level reached in 2023. The United States, the largest regional market, accounted for 68% of installations in the Americas in 2024.

Robot installations were down by 9% to 34,200 units. The Association for Advancing Automation (A3) tracks industrial robot and collaborative robot (cobot) sales in North America. A3 has seen a slight 4.3% increase in robot orders for the first half of 2025 compared to 2024.

The United States imports most of its robots from Japan and Europe, with few domestic suppliers. However, there are numerous domestic robot system integrators implementing robotic automation solutions, the IFR said.

Total installations in Mexico reached 5,600 units in 2024, a decrease of 4%. The automotive industry remained the key customer of industrial robots in Mexico, accounting for 63% of the installations in 2024. In Canada, robot installations declined by 12% to 3,800 units. Installation figures in Canada largely depend on automotive investment cycles. The share of the car industry was 47% in 2024.

Robot sales will remain positive in long term, IFR said

While the IFR predicts slower growth in the coming years, its overall outlook on the robotics industry is positive. | Source: IFR

The OECD and the IMF expect global growth in a range of 2.9% to 3.0% in 2025 and 2.9% and 3.1% in 2026. However, geopolitical tensions, violent conflicts in Eastern Europe and the Middle East, and trade disruptions are exerting their negative impact on the global economy.

The robotics industry is not immune to global macroeconomic conditions, the IFR noted, but there is no indication that the overall long-term growth trend will come to an end any time soon. While regional trends vary substantially, the aggregate global trajectory remains positive.

Globally, robot installations are expected to grow by 6% to 575,000 units in 2025. By 2028, the 700,000-unit mark will be surpassed.

Learn about China’s robotics boom at RoboBusiness

RoboBusiness 2025, which takes place Oct. 15 and 16 in Santa Clara, Calif., will feature presentations about China’s robotics boom and how the U.S. can compete in the coming years. Day 2 will include a keynote panel, “Closing the Robotics Gap with China,” with insights from:

Jeff Burnstein, the president of A3

George Stieler, the head of robotics and automation at Stieler Technology & Market Advisory

Eric Truebenbach, the managing director at Teradyne Ventures

During the session, the experts will discuss how global players can foster innovation ecosystems, strengthen supply chains, and accelerate commercialization to compete on the world stage. Additionally, Stieler will present in a session on the “Global Implications of China’s Robotics Push.”

RoboBusiness, the premier event for developers and suppliers of commercial robots, will be on Oct. 15-16 in Santa Clara, Calif. The event will feature tracks on enabling technologies, humanoids (new), business, design and development, and field robotics, as well as the Physical AI Forum.

This year’s conference will also include more than 60 speakers, a startup workshop, the annual Pitchfire competition, and numerous networking opportunities. Over 100 exhibitors on the show floor will showcase their latest enabling technologies, products, and services to help solve your robotics development challenges. Registration is now open.