Teradyne Robotics lays off another 14% of workforce

With advanced motion control, the UR8 Long can conduct automotive quality inspection. | Credit: Universal Robots

Roughly nine months after reducing its global workforce by 10%, Teradyne Robotics today had another round of layoffs. Teradyne’s robotics group cut about another 14% of its staff worldwide as revenue growth has not matched expectations. Teradyne owns collaborative robot arm maker Universal Robots and autonomous mobile robot developer Mobile Industrial Robots.

It’s unclear exactly how many employees were affected by the layoffs, but the company said reductions happened across its global teams. Universal Robots (UR) and Mobile Industrial Robots (MiR) are based in Odense, Denmark. Prior to the layoffs in January 2025, the Teradyne Robotics website said it had more than 1,400 employees worldwide.

Teradyne Robotics said this decision is not a sign of instability, but rather a “proactive step to strengthen the business and ensure we are focused on the areas where we can deliver the greatest value.” It added that the difficult decision was made to ensure long-term sustainability and operational efficiency.

“Over the last few years, Universal Robots and MiR grew rapidly to meet anticipated market needs,” Teradyne Robotics said in a statement to The Robot Report. “Around the same time, the global automation market slowed, particularly in Europe following the start of the war in Ukraine and widespread market uncertainty. As a result, revenue growth has not matched our expectations. Resizing is a strategic response to align our cost structure with current realities and refocus on our most impactful priorities.

Teradyne Robotics looks to AI

Teradyne Robotics said the long-term drivers for automation remain, including global labor shortages, reshoring, and manufacturing pressures. While the company said its commitment to customers remains unchanged, it did say there will be “some adjustments” to its product roadmap moving forward.

Teradyne didn’t provide specifics, but it said the group will “focus on the things that matter most, particularly AI, which will have a transformational impact on the way people work with robots over the coming years. An important element of our strategy is to establish UR cobots as the preferred platform for AI driven workcell applications and to deliver superior performance for our AMRs by leveraging AI features.”

In its Q3 earnings call last week, Teradyne said that over 8% of its robotics sales were for AI-related products, which is up from 6% in Q2 2025. The company also said volume shipments to a large e-commerce customer are not expected to have a material impact on its robotics revenue in 2025. Teradyne again didn’t share specifics, but could it be alluding to Amazon’s new Vulcan robot, which is being rolled out in warehouses around the world and uses a UR cobot?

Cobot competition increases

“We’ve taken the difficult but necessary step to resize our organization in response to ongoing market pressures,” said Jean-Pierre Hathout, who was named president of Teradyne Robotics in September 2025, taking over for Ujjwal Kumar. “This is about ensuring we remain focused, agile, and ready to deliver on the areas that matter including AI and strategic partnerships. We are deeply grateful to the colleagues who are leaving us and remain committed to supporting our customers and teams.”

Universal Robots pioneered the collaborative robot arm and remains a significant player, recently surpassing 100,000 units sold. However, like many early movers in technology, its long-standing market position is facing increased competition.

New entrants are joining the cobot market; established industrial automation providers such as ABB, FANUC, and KUKA have launched advanced cobot offerings; and lower-cost manufacturers from Asia are expanding their presence, putting pressure on UR’s dominance.

Teradyne, UR, MiR mark revenue drops

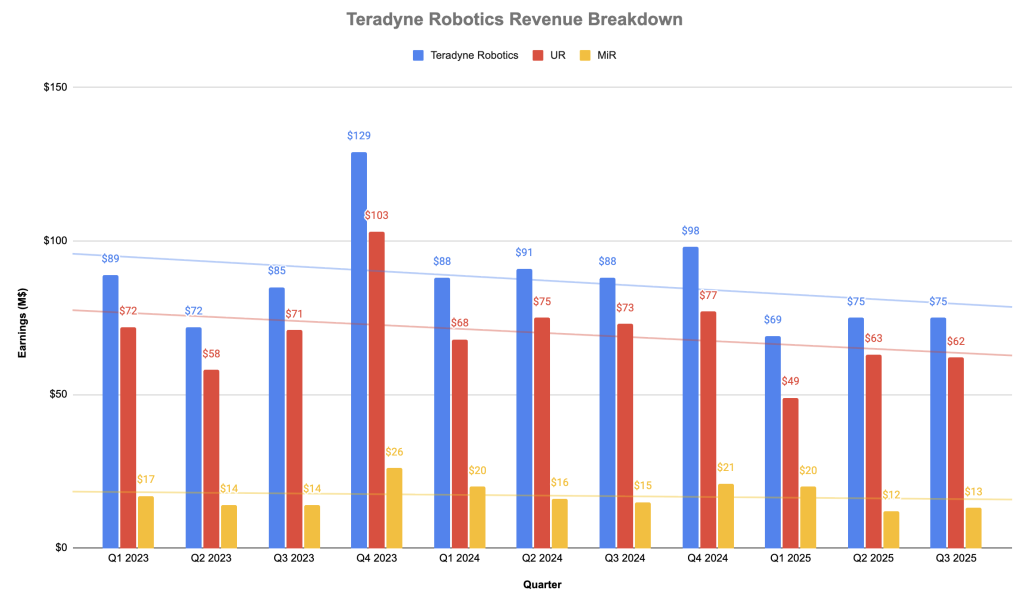

Click image to enlarge. | Credit: The Robot Report

The chart above shares the earnings from the past 11 quarters for MiR, UR, and Teradyne Robotics as a whole. It offers one view into how the group’s revenue has not met expectations. The fourth quarter of 2023 is an outlier in the chart, as the group’s revenue peaked at $129 million for the quarter, with UR chipping in most of the money. The average revenue for the other 10 quarters is as follows:

UR: $66.8M

MiR: $16.2M

Teradyne Robotics: $83M

Eighty-three million dollars per quarter is nothing to dismiss in the robotics world. After solid growth during the COVID-19 years, however, UR’s momentum has slowed. The company posted $311 million in revenue in 2021, up 41% from 2020 and 23% above 2019 pre-pandemic levels. Growth peaked at $326 million in 2022, then declined to $304 million in 2023 and $293 million in 2024.

If the current 2025 revenue-per-quarter pace continues, UR’s 2025 revenue would reach roughly $232 million — a decline of about $100 million, or 28%, from its 2022 peak.

In December 2024, UR announced that it was establishing manufacturing capabilities in Nantong, China. This was the first overseas production facility for UR, which said at the time it was looking to significantly expand its presence in China, the world’s largest market for industrial robots. UR is producing two cobots specifically for China: the UR7e and UR12e.

In September 2025, UR introduced the UR8 Long cobot, which offers the same 1,750 mm (68.9 in.) reach as the UR20 cobot but with a significantly slimmer profile. The UR8 Long has a payload capacity of 8 kg (17.6 lb.), which the company said makes it suitable for space-constrained setups and industrial tasks.